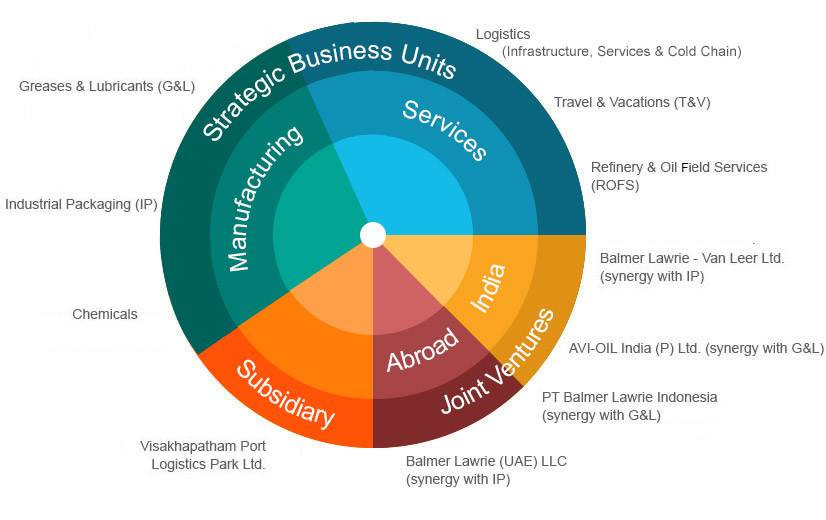

Founded by two Scotsmen, Stephen George Balmer and Alexander Lawrie, in Kolkata, Balmer Lawrie & Co. Ltd. started its corporate journey as a Partnership Firm on 1st February 1867. Traversing the 155 years gone by, today Balmer Lawrie is a Miniratna – I Public Sector Enterprise under the Ministry of Petroleum and Natural Gas, Govt. of India, with a turnover of Rs. 2105 crores and a profit of Rs. 170 crores. Along with its four Joint Ventures and one subsidiary in India and abroad, today it is a much-respected transnational diversified conglomerate with presence in both manufacturing and service sectors. Balmer Lawrie is a market leader in Steel Barrels, Industrial Greases & Specialty Lubricants, Corporate Travel and Logistics Services. It also has significant presence in most other businesses, it operates, viz, Chemicals, Logistics Infrastructure etc. In its entire years of existence, Balmer Lawrie has been successfully responding to the demands of an ever changing environment, leveraging every change as an opportunity to innovate and emerge a leader in industry.

Today Balmer Lawrie has eight business units – Industrial Packaging, Greases & Lubricants, Chemicals, Travel & Vacations, Logistics Infrastructure, Logistics Services, Cold Chain and Refinery & Oil Field Services with offices spread across the country and abroad.

Balmer Lawrie – Van Leer Ltd.

AVI-OIL India Pvt. Ltd.

Joint Venture Abroad

PT. Balmer Lawrie Indonesia

Balmer Lawrie (UAE) LLC

Subsidiary

Visakhapatnam Port Logistics Park Limited

History :

Driven by the spirit of entrepreneurship, two enterprising Scotsmen Stephen George Balmer and Alexander Lawrie sowed the seeds of this company at Kolkata on 1st February, 1867. History goes…a coin was tossed…Balmer won…Balmer’s name preceded in the Firm incorporated and thus was born Balmer Lawrie.

There was hardly any business where Balmer Lawrie did not delve into in its formative years, whether it was from Tea to Shipping, Insurance to Banking or Trading to Manufacturing. The company has left a mark of its own at every step of its remarkable corporate journey.

Today, Balmer Lawrie is a Mini-Ratna-I Public Sector Enterprise, under the Ministry of Petroleum & Natural Gas of India. It has eight Strategic Business Units – Industrial Packaging, Greases & Lubricants, Chemicals, Travel & Vacations, Logistics Infrastructure, Logistics Services, Cold Chain and Refinery & Oil Field Services, with offices spread across the country and abroad. Balmer Lawrie has grown enormously in the last 155 years and has become the market leader in Steel Barrels, Industrial Greases & Specialty Lubricants, Corporate Travel and Logistics Services. It has very well responded to the demands of an ever changing environment and has taken full advantage of every opportunity to innovate. Balmer Lawrie also grew inorganically through various JVs over the period of time.

Company Is almost Debt Free .

It Maintains Healthy Dividend Payout 81.78% .

ROCE : Decreasing YOY .

All Information is For Study Purposes Only .

Company Name : Balmer Lawrie & Company ltd .

CMP : 109/- ( On 17.07.2022)

52 Weeks High/Low : 103.20/145.50 .

Target : Short Term (6 Months ) : 125 to 145 ++

Expected to Give Good Dividends this Year also .

Based on Technical Charts

Disclaimer: I am Not a SEBI REGISTERED ANALYST. This Website & Its Owner, Creator & Contributor is Neither a Research Analyst nor an Investment Advisor and Expressing Option Only as an Investor in Indian Equities. All trading strategies are used at your own risk.

He/ She are Not Responsible for any Loss a Rising out of any Information, Post or Opinion Appearing on this Website. Investors are advised to do Own Due Diligence or Consult Financial Consultant before acting on Such Information. Author of this Website not providing any Paid Service and not Sending Bulk mails/SMS to Anyone. Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Investment/Trading in securities Market is subject to market risk.