In the speculations, an organization’s cost to-income proportion, or P/E proportion, is a proportion of its stock value comparative with its profit. In case you’re attempting to decide if a stock is a wise venture, the P/E proportion can assist you with checking the future bearing of the stock and whether the cost is, generally, high or low contrasted with the past or different organizations in the equivalent .

Made famous by the late Benjamin Graham, who was named the “Father of significant worth contributing” just as Warren Buffett’s guide, Graham lectured the ideals of this money related proportion as one of the snappiest and least demanding approaches to decide whether a stock is exchanging on a venture or theoretical premise, frequently offering a few alterations and extra explanation so it had included utility when seen considering an organization’s general development rate and basic winning .

An income report discloses to you how the organization is performing. A P/E proportion reveals to you how financial specialists see how the organization is performing. As such, the amount they are happy to pay for a dollar of income.

P/E Ratio Means :

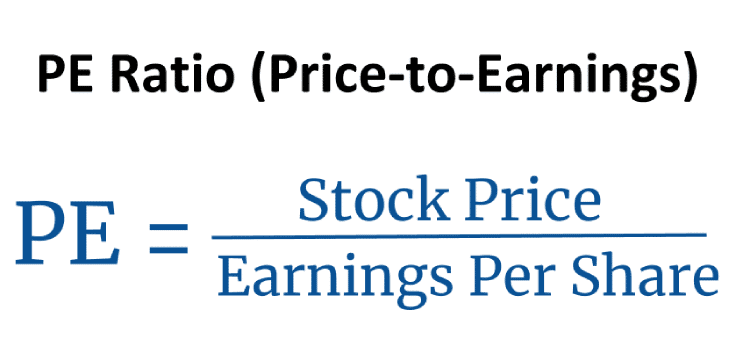

Before you can exploit the P/E proportion in your own contributing exercises, you should comprehend what it is. Basically, the P/E proportion is the value a speculator is paying for RS.1 of an organization’s profit .

As it were, if an organization is announcing fundamental or weakened income per portion of RS.2 and the stock is selling for RS.20 per share, the P/E proportion is 10 (RS.20 per share isolated by RS.2 profit per share = 10 P/E).

For conservatism, utilize weakened income per share while figuring the P/E proportion so you represent the potential or expected weakening that can or will happen because of things like investment opportunities or convertible favored stock.

This is particularly valuable in light of the fact that, on the off chance that you upset the P/E proportion by taking it partitioned by 1, you can figure a stock’s profit yield. This can permit you to all the more effectively think about the arrival you are really procuring from the fundamental organization’s business to different speculations, for example, Treasury bills, securities, and notes, declarations of store and currency markets, land.

For whatever length of time that you do your due constancy, paying special mind to marvels, for example, esteem traps, seeing both the individual stocks you hold in your portfolio, and your portfolio in general, through this viewpoint can assist you with abstaining from escaping in air pockets, lunacies, and frenzies. It drives you to glance through the financial exchange and spotlight on the fundamental monetary reality.

P/E Ratios by Industry ?

Various enterprises have diverse P/E proportion runs that are viewed as typical for their industry gathering. For instance, social insurance organizations may sell at a normal P/E proportion of 34, while vitality part organizations may just exchange at a normal P/E proportion of 12.5 . There are special cases, however these changes among parts and enterprises are totally adequate.

They emerge, to some extent, out of various desires for various organizations. Programming organizations as a rule sell at bigger P/E proportions since they have a lot higher development rates and win better yields on value, while a material plant, subject to bleak net revenues and low development possibilities, may exchange at an a lot littler numerous. Now and again, the circumstance is flipped completely around.

In the result of the Great Recession of 2008-2009, innovation stocks exchanged at lower cost to-income proportions than numerous different sorts of organizations since speculators They needed to possess organizations that made items and that individuals would keep buying regardless of how stressed their accounts.

The significant thing to recollect is that there is definitely not a set standard you can apply. You should factor in what is happening on the planet. For instance, if the economy is in a tough situation or there is a worldwide wellbeing emergency, corporate profit can be more terrible than anticipated. This brings down speculator desires, and stock costs will go down. Regardless of whether the market appears to be genuinely esteemed at a P/E proportion of 14, terrible occasions could cause the market profits to proceed for a descending winding with the P/E proportion going a lot of lower.

Then again, during blasting economies, corporate profit can proceed to rise, and stock costs can increment for a long time in succession. A P/E proportion of 16, or even 20, doesn’t consequently mean the market is overrated. In the mid ’90s, numerous who thought the market was exaggerated dependent on P/E proportions missed the incredible returns of 1994 to 1999.

Such circumstances tend possibly emerge like clockwork however when they do, track cautiously and ensure you realize what you are doing.

Looking at Companies Using P/E

Not with standing helping you figure out which enterprises and parts are overrated or undervalued, you can utilize the P/E proportion to analyze the costs of organizations in a similar zone of the For instance, if organization ABC and XYZ are both selling for Rs.50 an offer, one may be unquestionably more costly than the other relying on the basic benefits and development paces of each stock.

Organization ABC may have detailed profit of Rs.10 per share, while organization XYZ has revealed income of Rs.20 per share. Each is selling on the securities exchange for Rs.50. I don’t get this’ meaning? Organization ABC has a cost to-profit proportion of 5, while Company XYZ has a P/E proportion of 2.5. This implies organization XYZ is a lot less expensive on a relative premise.

For each offer bought, the speculator is getting RS.20 of income instead of RS.10 in profit from ABC. All else being equivalent, a savvy financial specialist ought to select to buy portions of XYZ. At precisely the same cost, RS.50, he is getting double the acquiring power.

Key P/E Ratio Analysis to understand :

Because a stock is modest doesn’t mean you should get it. Numerous financial specialists favor the PEG Ratio, rather, in light of the fact that it factors in the development rate. Even better is the profit balanced PEG proportion since it takes the fundamental cost to-income proportion and alters it for both the development rate and the profit yield of stock.

In the event that you are enticed to purchase a stock on the grounds that the P/E proportion seems appealing, do your examination and find the reasons. Is the board genuine? Is the business losing key clients? Is it just an instance of disregard, as occurs every once in a while even with incredible organizations? Is the shortcoming in the stock cost or basic money related execution an aftereffect of powers over the whole segment, industry, or economy, or is it brought about by firm-explicit awful news? Is the organization going into a perpetual condition of decrease?

When you get progressively experienced, you will really utilize an adjusted type of the P/E proportion that changes the “e” divide (income) for a proportion of free income. You can take a stab at something many refer to as proprietor profit. Fundamentally, use it, balanced for transitory bookkeeping issues, and attempt to make sense of what you’re paying for the center monetary motor comparative with circumstance costs. At that point, develop a portfolio starting from the earliest stage that contains singular segments that were appealing as well as together diminishes chance.

Disclaimer: I am Not a SEBI REGISTERED ANALYST. This Website & Its Owner, Creator & Contributor is Neither a Research Analyst nor an Investment Advisor and Expressing Option Only as an Investor in Indian Equities. All trading strategies are used at your own risk. He/ She are Not Responsible for any Loss a Rising out of any Information, Post or Opinion Appearing on this Website. Investors are advised to do Own Due Diligence or Consult Financial Consultant before acting on Such Information. Author of this Website not providing any Paid Service and not Sending Bulk mails/SMS to Anyone. Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Investment/Trading in securities Market is subject to market risk.