What is a lower or upper circuit?

Lower or upper circuit is a programmed system to stop a free fall or enormous flood in a security or a file during exchanging hours. It is utilized to check the unstable swings in the market.

When is circuit Limit Increases or Decreases?

The file based market-wide electrical switch framework applies at three phases of the list development, whichever way at 10 %, 15 % and 20 %. These circuit breakers when activated achieve a planned exchanging stop all value and value subsidiary markets across the country. The market-wide circuit breakers are activated by development of either the BSE Sensex or the Nifty 50, whichever is penetrated prior.

What occurs after the exchanging time term is finished?

After the circuit is penetrated, exchanging is stopped as referenced previously. The market re-opens, after record based market-wide circuit channel break, with a pre-open call closeout meeting of 15 minutes post the span of stop. The ordinary exchanging could start and proceed as long as the following circuit limit doesn’t actuate.

What is the duration of End Time in trade?

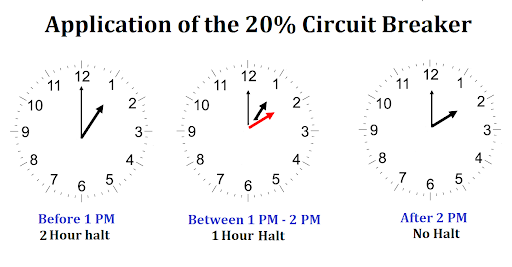

It depends on the time of the breach and the quantum of fall. Trade could be halted for 15 minutes up to the whole day. A detailed mechanism is as followed: 10% trigger limit: If this limit is breached before 1 pm, trade is halted for 45 minutes. If the same is breached between 1 pm to 2.30 pm, trade is halted for 15 minutes. After 2.30 pm, there is no halt in trading. 15% trigger limit: If this limit is breached before 1 pm.

Why is circuit limit Changes?

The circuit levels are dictated by the stock trades to shield financial specialists and merchants from an undesirable shock second. If there should be an occurrence of an abrupt swing speculators will in general lose a huge piece of their capital. Indeed, even merchants may need to confront edge calls from their intermediaries in the event that market plunges .

Disclaimer: I am Not a SEBI REGISTERED ANALYST. This Website & Its Owner, Creator & Contributor is Neither a Research Analyst nor an Investment Advisor and Expressing Option Only as an Investor in Indian Equities. All trading strategies are used at your own risk. He/ She are Not Responsible for any Loss a Rising out of any Information, Post or Opinion Appearing on this Website. Investors are advised to do Own Due Diligence or Consult Financial Consultant before acting on Such Information. Author of this Website not providing any Paid Service and not Sending Bulk mails/SMS to Anyone.Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Investment/Trading in securities Market is subject to market risk.