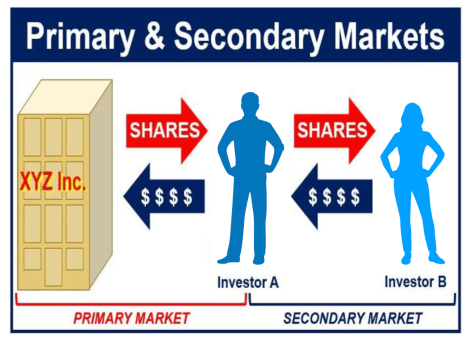

Organizations raise momentary assets through the currency showcase. In any case, when the prerequisites are for long haul, this is the place the capital market comes in picture. The capital market contains essential and auxiliary market.

Presently we should comprehend top to bottom about the primary and secondary market and what the distinction among primary and secondary market .

primary market is where protections are given by the organization just because to overall population for bringing assets up in request to satisfy the drawn out capital necessity. Issues are made in different structures like open issues, offer available to be purchased, rights issue, reward issue, issue of IDR, and so on.

While secondary market is where existing protections like offers, debentures, securities, choices, business papers, treasury bills, and so forth are exchanged among financial specialists. It resembles a sale showcase where the exchanging of protections is done through trade or a seller

primary market is a business opportunity for making of long haul capital.

New issue of protections happens in secondary market.

Secondary market encourages the liquidity and attractiveness of existing protections.

Secondary market guarantees a valid and reasonable managing for insurance of the speculator’s advantage.

The contrast between the primary and secondary market for the most part identifies with the idea of financing and the associations in question. The essential contrasts between the two kinds of market are as per the following:

The protections that are in the past given in a market are alluded to as primary market, while, when the organization gets recorded on a perceived stock trade for exchanging, at that point the stocks are exchanged secondary market.

primary market is otherwise called another issue showcase and the optional market is known as after issue advertise. Contingent on the interest and gracefully of the protections exchanged the costs the secondary market differ. While in essential market the costs are fixed.

The primary market gives financing to the new and the old organizations for their extension and enhancement while the optional market doesn’t give financing to organizations as they are not associated with any exchanges.

In primary market the financial specialists can buy the offers straightforwardly from the organization, while in secondary market, the speculators,investors,Traders can purchase and sell the Shares (offers and securities) among themselves.

If there should be an occurrence of primary market, speculation brokers do the selling. On the other hand in optional market, the agent goes about as a delegate while the exchanging is finished.

In primary market, the organization will pick up from the offer of security. While in optional market, financial specialist will pick up from the protections.

The protections in the essential market must be sold once, while in optional market it very well may be done a limitless number of times.

The sum that is gotten from the protections turns into the capital for organization though; if there should be an occurrence of secondary market same is the salary of financial specialists.

Henceforth, from the above pointers we presume that the two budgetary markets (primary market and secondary market) assume a significant job in the preparation of cash in the nation’s economy. The essential market energizes an immediate cooperation with the organization and the financial specialist. While, optional market is the place merchants help out the speculators to purchase and sell the stocks among different financial specialists.

The procedure to purchase Equity in primary market is simple. The accompanying methodology is followed while purchasing or selling shares in the primary market.

Open demat account with a depository participant (DP).

Open a trading account with a Stock broker(Pool Account).

Linking your bank account & PAN CARD with demat and trading account.

The Stock broker buys or sells the shares by executing orders on the electronic terminal provided by the stock exchanges which ever investor prefers.

A contract note is issued by the broker detailing the value of shares purchased and his brokerage Rate.

The Stock broker collects shares via settlement process (T+1) and makes payment on the behalf of investor.

Order gets executed on the final settlement date (T+2) days.

Disclaimer: I am Not a SEBI REGISTERED ANALYST. This Website & Its Owner, Creator & Contributor is Neither a Research Analyst nor an Investment Advisor and Expressing Option Only as an Investor in Indian Equities. All trading strategies are used at your own risk. He/ She are Not Responsible for any Loss a Rising out of any Information, Post or Opinion Appearing on this Website. Investors are advised to do Own Due Diligence or Consult Financial Consultant before acting on Such Information. Author of this Website not providing any Paid Service and not Sending Bulk mails/SMS to Anyone. Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Investment/Trading in securities Market is subject to market risk