The company wants to become the fastest-growing and most competitive cement company in eastern India.

To achieve 15 million metric tonnes of capacity by 2026.

Star Cement Limited is the leading cement company in North-Eastern India and one of the fastest-growing cement brands in West Bengal and Bihar, acquiring a strong foothold in the Indian construction industry.

Star Cement Ltd. has established itself as the most accredited brand in the region for providing high-quality cement at fair pricing.

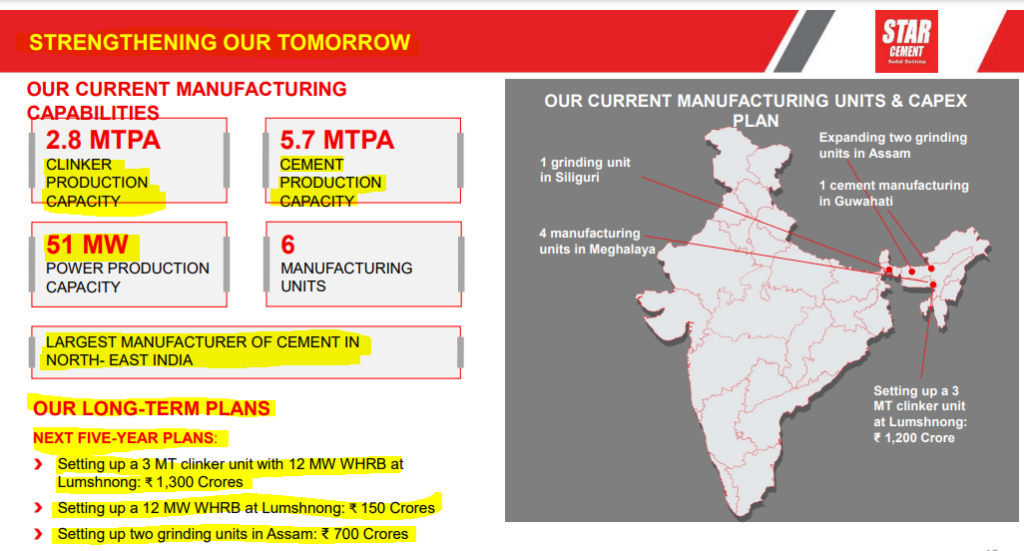

Spread across 200 hectares of land, the company has its 1.67 million metric tonnes per annum (MTPA) integrated cement plant in a strategic location in the idyllic town of Lumshnong in Meghalaya that ensures easy availability of high-grade limestone.

In addition, the company has two grinding units: a 2 million tonnes per annum (MTPA) cement unit in Sonapur near Guwahati and another cement unit at Mohitnagar near Siliguri in West Bengal with a capacity of 2 million tonnes per annum (MTPA), thereby aggregating an installed capacity of around 5.7 MTPA.

Star Cement has gained a prominent position in the Indian construction industry for its premium-quality cement, focusing on sustainable development, to meet today’s challenging building material needs and home-building aspirations of millions of customers, supported by pioneering marketing initiatives.

Star Cement, as a brand, goes beyond manufacturing and selling its products, it also provides technical support, best-in-class home building solutions, and services to customers at all stages of the construction process, from foundation to roof.

The brand believes in strong and socially responsible corporate governance by playing a pivotal role in safeguarding the environment, promoting economic development,

strengthening livelihoods and social development and fulfilling its responsibilities towards society with consistent corporate social responsibility initiatives.

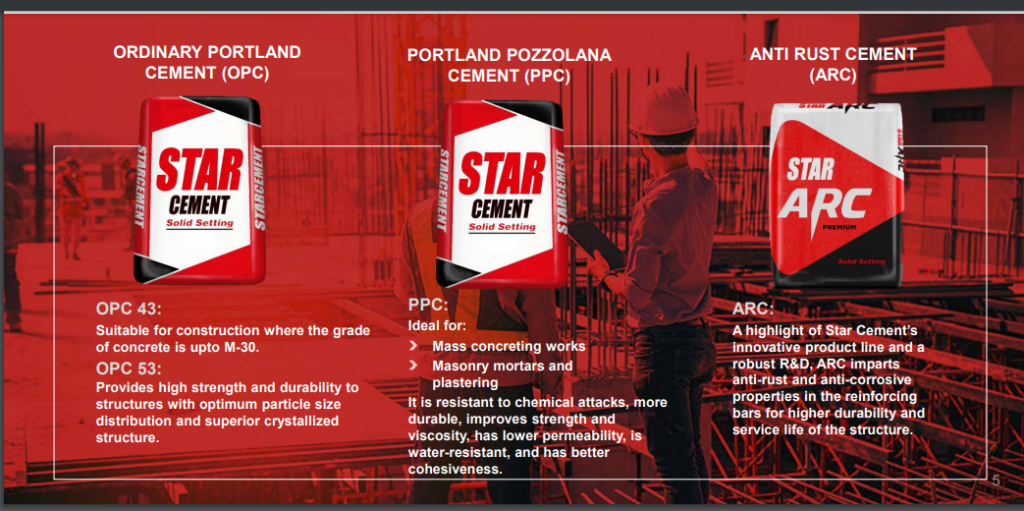

Our product range for construction includes

Ordinary Portland Cement (OPC 43-Grade) and

(OPC 53-Grade) and Portland Pozzolana Cement (PPC),

Portland Slag Cement (PSC) and a marquee product in the value-added segment of Anti-Rust Cement (ARC)

in line with evolving customer and construction needs.

Our product range is known for competence and quality, making it an unprecedented choice for customers, engineers, dealers, and contractors.

Star Cement Limited is listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

It is an ISO 9001:2015, ISO 14001:2015, ISO 45001:2018, and OHSAS 18001 certified company.

Star Cement made a significant contribution and was a proud partner in the construction of numerous landmark projects.

The company made the biggest private sector investment of more than Rs. 2227 crore in the North Eastern region.

Star Cement is a proud partner in the construction of the Bogibeel Bridge, India’s longest rail and road bridge, and Dr. Bhupen Hazarika Setu, the longest bridge in India over water.

Assam

Guwahati Games Village and Stadium

Hotel Radisson Guwahati

Guwahati Inter-State Bus Terminal (ISBT)

Sun Pharma Factory

Emami Factory

Britannia Factory

Ajanta Pharma Factory

Century Ply Factory

ITC Factory

Guwahati New Airport Terminal Building

Tezpur University

Indian Statistical Institute, Tezpur

Dibrugarh Airport New Terminal Building

Dabur Factory, Tezpur

Royal Global University, Guwahati

Berger Paints Factory at Naugaon

National Institute of Technology (NIT), Silchar

NTPC, Salakati

Indian Institute of Technology (IIT) Guwahati

NHAI: Kokrajhar to Guwahati to Naugaon to Lumding to Haflong (around 400 km stretch)

Arunachal Pradesh

Kameng Hydroelectric Power Project

Pare Hydroelectric Power Project

Lower Subanshri Hydroelectric Power Project

National Institute of Technology (NIT)

Capital Complex Building, Itanagar (Secretariat)

Manipur

Jiribam Noney Railway Project

RIMS Imphal

Imphal Airport

Imphal-MMorey International Highway Project

Tripura

Agartala Airport Parking Bay and the New Terminal Building

Agartala Railway Station

Agartala-Silchar Railway Route

Agartala Secretariat

Agartala Flyover

Palatana Power Project

Plants :

LUMSHNONG, MEGHALAYA

Our state-of-the-art cement plant is located in the idyllic town of Lumshnong and is spread over 200 hectares of land.

The plant is strategically positioned in Meghalaya, close to its mines that produce India’s finest lime stones, ensuring very high-quality cement.

Star Cement has its 1.67 million tonnes per annum (MTPA) integrated grinding unit,

equipped with state-of-the-art German technology.

The plant is the largest in north-eastern India.

The company also has a clinker capacity of 2.8 million tonnes per annum (MTPA) and 51 MW of captive power generation facilities.

The cement plant boasts a 24-hour automated camera in the burning zone, an automatic rotopacker machine, and a technologically advanced dry process rotary.

It is fully automatic, and the systems are controlled by a team of experts through supercomputers in the Central Control Room (CCR), situated at the heart of the plant.

This ensures minimal variations in the quality of the cement being produced.

Emphasis on quality has garnered Star Cement international certifications, including ISO 9001:2008, ISO 14001:2004, and OHSAS 18001.

SONAPUR-GUWAHATI, ASSAM

The production of the Lumshnong plant is supplemented by that of stand-alone grinding units at Sonapur, near Guwahati.

Set up in 2013, equipped with cutting-edge technology, the grinding unit in Sonapur has a capacity of 2 million tonnes per annum (MTPA).

MOHITNAGAR JALPAIGURI, WEST BENGAL

Commissioned in 2021, Star Cement’s Grinding Unit in Mohitnagar near Jalpaiguri town, in addition to cement manufacturing units in Lumshnong in Meghalaya and Sonapur near Guwahati, has augmented cement manufacturing capacity to 5.7 million tonnes per annum (MTPA).

Spread over 45 acres, Siliguri Grinding Unit is a greenfield project set up with the latest state-of-the art German technology and has a capacity of 2 million metric tonnes per annum

Expansion plan :

Source of information : https://www.starcement.co.in/

Company Name in BSE : Star Cement

Cmp : 143 (09.06.2023)

52 Weeks High/Low : 148/81.50 (24.08.2021)

Target : – 220-350++

Time Period : 3 Months to 2 years

STUDY PURPOSE ONLY .

Disclaimer: I am Not a SEBI REGISTERED ANALYST. This Website & Its Owner, Creator & Contributor is Neither a Research Analyst nor an Investment Advisor and Expressing Option Only as an Investor in Indian Equities. All trading strategies are used at your own risk.

He/ She are Not Responsible for any Loss a Rising out of any Information, Post or Opinion Appearing on this Website. Investors are advised to do Own Due Diligence or Consult Financial Consultant before acting on Such Information.

Author of this Website not providing any Paid Service and not Sending Bulk mails/SMS to Anyone. Information is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Investment/Trading in securities Market is subject to market risk. This is my personal thoughts on this company and not at all a buy recommendation. Do own due diligence /consult a SEBI registered advisor before any action.